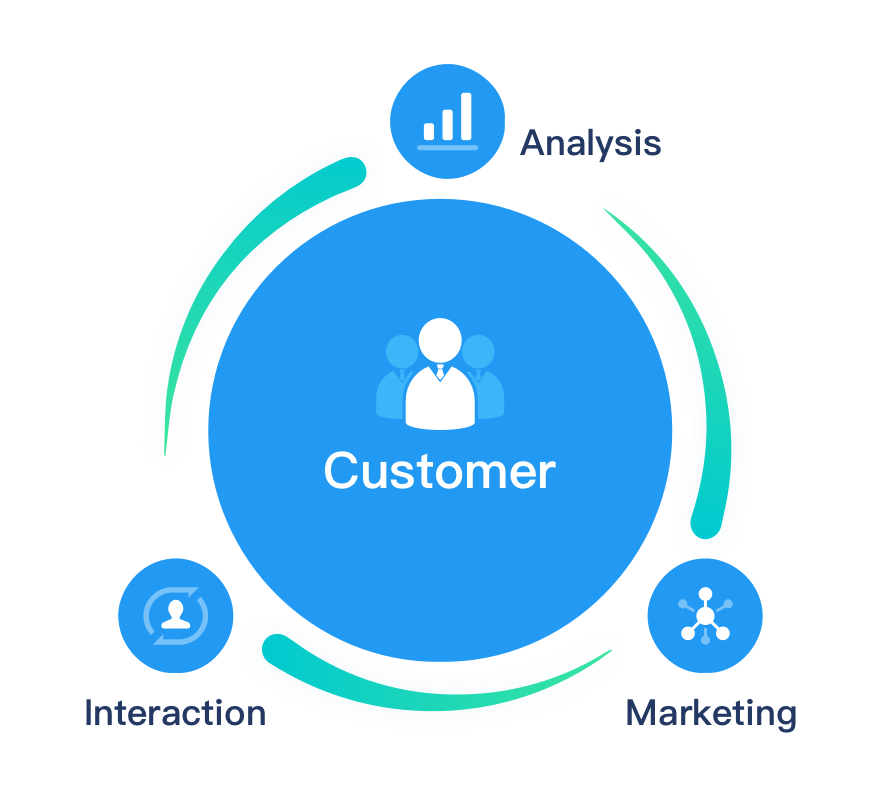

Through a customer tagging system, CDP accurately maps user profiles, identifies high-value customer segments, and establishes an indicator system suitable for internet operations in the financial industry.

By integrating user profiles with operational strategies across various stages of the user lifecycle, CDP conducts targeted product operations and event planning, achieving refined "one-to-one" marketing.

Connect me with a sales rep

Connect me with a sales rep

Login

Login